As of May 20, 2022, the country has 34,989 valid projects with a total registered capital of over USD 426.14 billion. The accumulated realized capital of foreign investment projects is estimated at USD 259.31 billion, equaling 60.9% of the total valid registered investment capital.

Details are as follows:

A- Operation status

Realized capital:

As of May 20, 2022, estimated that foreign investment projects have disbursed USD 7.71 billion, up 7.8% over the same period in 2021.

Import and export situation:

Export: Export turnover of the foreign investment sector continued to increase in the first 5 months of 2022. Exports (including crude oil) were estimated at over USD 115.29 billion, up 17.6% over the same period last year. Exports excluding crude oil were estimated at over 114.32 billion USD, up 17.4% over the same period last year.

Import: Import of the foreign investment sector was estimated at nearly USD 101.45 billion, up 17.9% over the same period last year.

Generally, in the first 5 months of 2022, the foreign investment sector had a trade surplus of over USD 13.8 billion including crude oil and a trade surplus of nearly USD 12.9 billion excluding crude oil. Meanwhile, the domestic business sector had a trade deficit of over USD 12.3 billion.

B- Investment registration status

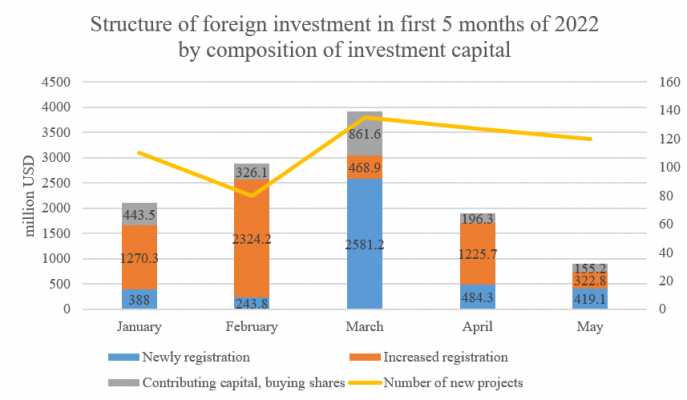

As of May 20, 2022, the total newly registered capital, adjusted capital and contributed capital to buy shares by foreign investors reached over USD 11.71 billion, equaling 83.7% over the same period in 2021. Although newly registered investment capital continued to decrease, both adjusted investment capital, capital contribution and share purchase have increased sharply compared to the same period last year. Specific:

Newly registered capital: There were 578 new projects granted investment registration certificates (down 5.7% over the same period), the total registered capital was nearly USD 4.12 billion (down 53.4% over the same period).

Adjusted capital: There were 395 times of projects registered to adjust investment capital (up 15.5% over the same period), the total additional registered capital reached over USD 5.61 billion (up 45.4% over the same period).

Contributing capital, buying shares: There were 1,339 times of capital contribution and share purchase by foreign investors (down 5.8% over the same period), the total value of contributed capital reached over USD 1.98 billion (up 51.6% over the same period).

By industry:

Foreign investors have invested in 18 sectors out of a total of 21 national economic sectors. In which, the processing and manufacturing industry leads the way with a total investment of over USD 6.8 billion, accounting for 58.2% of the total registered investment capital. Real estate business ranked second with a total investment of nearly USD 3 billion, accounting for 25.6% of total registered investment capital. Next are the information and communication industries; scientific and technological activities with a total registered capital of nearly USD 398 million and nearly USD 374.8 million respectively. The rest are other industries.

In terms of the number of new projects, wholesale and retail, the manufacturing and processing industry and professional science and technology activities are the industries that attract the most projects, accounting for 29.6%, 25.6% and 17.5% of total projects.

By investment partner:

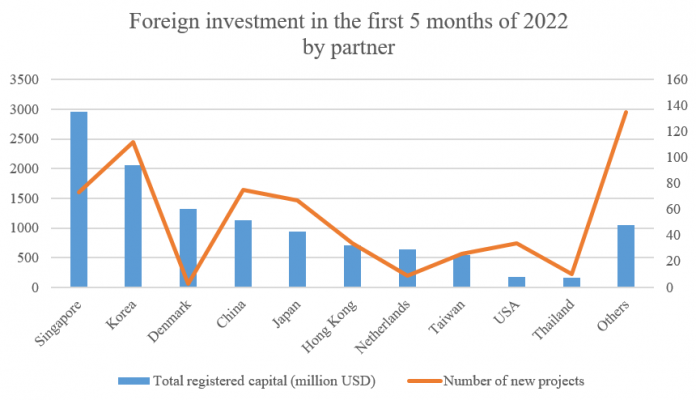

There were 79 countries and territories investing in Vietnam in the first 5 months of 2022. In which,

- Singapore leads the way with a total investment of nearly USD 3 billion, accounting for 25.3% of total investment capital in Vietnam, down 43.8% over the same period in 2021;

- Korea ranked second with over USD 2.06 billion, accounting for 17.6% of total investment capital, up 12.6% over the same period;

- Denmark continues to rank third with a total registered investment capital of nearly USD 1.32 billion, accounting for 11.3% of total investment capital with a large-scale Lego project with a total investment of over USD 1.3 billion;

- Followed by China, Japan, Hong Kong.

According to the number of projects, Korea is still a partner with investors interested in and making new investment decisions as well as expanding investment projects and contributing capital, buying shares the most in the first 5 months of 2022 (accounting for 19.4% of new projects, 33.9% of adjustments and 36.7% of times of capital contribution or share purchase).

By investment area:

Foreign investors have invested in 48 provinces and cities across the country in the first 5 months of 2022.

- Binh Duong leads the way with a total registered investment capital of over USD 2.52 billion, accounting for 21.5% of total registered investment capital and nearly 2.3 times higher than the same period in 2021.

- Bac Ninh ranked second with a total investment capital of nearly USD 1.65 billion, accounting for 14.1% of total capital.

- Ho Chi Minh City ranked third with a total registered investment capital of over $1.3 billion, accounting for 11.3% of total capital and a slight decrease of 1.1% over the same period in 2021.

- Followed by Thai Nguyen, Hai Phong, Hanoi.

In terms of the number of new projects, foreign investors still focus on investing in big cities with convenient infrastructure such as Ho Chi Minh City and Hanoi. In which, Ho Chi Minh City leads in number of new projects (40.3%), number of times of capital contribution and share purchase (67.9%) and second in number of projects with capital adjustment (13.69%, in which, Hanoi ranks first with nearly 17%).

Tiếng Việt

Tiếng Việt